The Ontario government’s rent control proposal, announced in its Fair Housing Plan, could stall the construction of new purpose-built rental apartments in the Greater Toronto Area, according to those involved in the sector.

Federation of Rental-housing Providers of Ontario (FRPO) president and chief executive officer Jim Murphy is disappointed the proposed rollback – which he said could be “very damaging” to the future supply of rental housing – was made without formal consultation with the industry directly responsible for the development and operation of rental housing.

“We saw a 50 per cent increase in professionally managed, purpose-built rental apartment units last year in the Toronto area and there are 28,000 in the pipeline in the Toronto area,” said Murphy, adding that 90 per cent of FRPO members who responded to a recent survey wanted to build apartments.

$2.7 billion in investment “at risk”

“A change in the post-1991 exemption will put roughly $2.7 billion at risk in terms of investment,” Murphy continued. “This will act as a deterrent to those projects moving forward and that’s not a good thing for either investment within the province or for tenants.”

Murphy said 30 per cent of condominium units in the Toronto area are rented and new controls could hurt small investors who own one or two units to supplement their income. It could also discourage others from doing the same in the future.

FRPO represents more than 2,200 rental housing providers who supply and manage homes for more than 350,000 tenant households across Ontario.

Liberals “attack an imaginary problem”

“The Liberals couldn’t have picked a worse time to attack an imaginary problem,” said Derek Lobo, chief executive officer of SVN Rock Advisors Inc., a Burlington, Ont.-based boutique brokerage firm focused on multi-family asset classes, including apartments, student housing, multi-family land and new apartment construction.

Lobo said plenty of developers have recently become interested in building rental apartments. He believes the announcement is ill-timed and politically motivated, similar to when the Ontario government said it would lower hydro rates earlier this year in a bid to boost its popularity.

Rent controls could seriously dampen developer interest in the purpose-built rental sector, he added, citing 40 years of relative inactivity after legislation was introduced in the province in 1975.

“If rent controls are such a good idea, Ontario would have a booming rental industry. We’d have had 40 years of it. We have a broken industry because of regulations.

“Go to Alberta or Dallas or someplace like that where they haven’t had rent control legislation and you’ll find that there’s a good cross-section of rentals available.”

Condo rent increases partly to blame

Lobo believes the government was moved to impose rent controls at least partially because of recently publicized cases where people renting condo units in buildings erected after 1991 were suddenly hit by price increases of $1,000 or more per month.

He said no one wants to see such hefty rent increases and that problems with a few condo unit owners shouldn’t have led to proposed blanket legislation covering all rentals.

“Some individual unsophisticated landlords bought places and rented them out for $1,500 and realized that the rent was too low and that they could get more and raised rents by $1,000,” Lobo said. “There’s no professional landlord who was wrong by $1,000. He wouldn’t be a professional landlord.”

Rents are based on what the market can bear and, going by the very low vacancy rates in the GTA, Lobo thinks they’re fair.

“If you get your rents right the first time you’re not going to get those big increases anyways,” he said. “You can’t charge more than the market.

“If you lifted rent controls completely, do you think rents in Ontario would double? No, they can’t.”

Measures meant to cool housing market

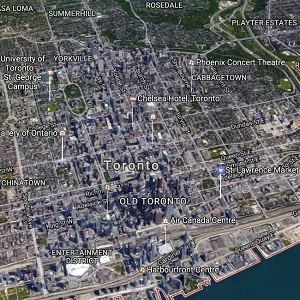

The implementation of rent controls was one of three major measures introduced by the Ontario government on Thursday in order to cool the housing market in Toronto and its surrounding environs.

The plan, tabled by the Liberals and Premier Kathleen Wynne, contains a series of 16 measures designed to “help more people find an affordable place to call home, while bringing stability to the real estate market and protecting the investment of homeowners,” according to a government release.

The other key moves are a 15 per cent Non-Resident Speculation Tax to be applied in the Greater Golden Horseshoe (GGH) area in and around Toronto, Niagara and parts of central Ontario, and allowing Toronto and “potentially other interested municipalities” to introduce a tax on vacant homes.

The controversial non-resident tax is similar to an initiative implemented by the British Columbia government in 2016, which led to a temporary slowdown in the Vancouver area’s similarly hot housing market.

In the Ontario move, the tax will apply to non-Canadian citizens, non-permanent residents and non-Canadian corporations that buy residential properties of one to six units in the GGH.

Toronto house prices jumped 33 per cent

Among the other measures is a $125-million, five-year program to rebate a portion of development charges on new purpose-built rental apartment buildings.

It will also create what the government calls a “Housing Supply Team” of provincial employees to “identify barriers to specific housing development projects and (to) work with developers and municipalities to find solutions.”

Some statistics released by the government to support these moves:

* After two consecutive years of double-digit gains, average house prices in the Toronto region reached $916,567 in March 2017, up 33.2 per cent year-over-year;

* RBC Economics recently highlighted that housing affordability in the Toronto area for the fourth quarter of 2016 was at its second-worst level on record since the mid-1980s;

* According to Urbanation, the average rent per square foot for new leases in the GTA condo market rose 11 per cent in the last quarter of 2016 compared to a year earlier, the fastest pace of growth since at least 2011;

* Ontario’s average vacancy rate dropped to 2.1 per cent in the fall of 2016, from 2.4 per cent in 2015, which was the lowest since October 2003. The Toronto vacancy rate was 1.3 per cent, the lowest in 12 years.