GUEST COLUMN: On Sept. 20, Canadians elected a minority Liberal government with Justin Trudeau as the continuing prime minister. No matter which party you support, the consensus is that housing has been key for voters, along with all the fallout from COVID-19: healthcare, economic recovery and jobs.

Frustration about housing continues to escalate.

Homeowners, renters and those looking to move out on their own all feel the pinch, albeit differently. Small, medium and large communities alike bear the impact of the past 18 months as the pandemic has shifted how we live, work and play.

Many rural communities have seen influxes of new residents buoyed by opportunities to work from home and change their full- or part-time locations. Some areas have suffered from elevated traffic, but others, like our urban cores, have deteriorated from lack of pedestrians, consumers and office/retail workers.

Rental vacancy back in decline

Rental vacancies are again starting to decline, returning to pre-pandemic levels in some cases. Rental rates will correspondingly increase moving forward.

We’ve spoken recently with multiple large-scale portfolio owners, all indicating that their buildings are full. This is in stark contrast to a year ago, especially in areas close to post-secondary housing.

While increasing rental housing continues to be identified as a core need, the case for actually building and delivering units continues to be difficult.

A federal housing plan enabling tangible options with all levels of government working in tandem would be welcome. For years, Goodman Commercial has advocated for the removal of the self-assessed GST required on new builds and substantial renovations.

The federal Liberals campaigned on this promise the last time around but never followed through on removing the tax.

Should the government finally lift this impediment, a significant number of projects nationally would have the opportunity to move forward with less cost, benefitting occupants for decades to come.

In B.C., rent freeze ends, but 1.5% increase won’t cut it

Meanwhile, B.C. has been wrestling with the provincial government’s pandemic-era freeze on rent increases. In March 2021, Goodman reported that by end-2021, rental providers would face two full calendar years of rent freezes.

Further, once increases were again permitted, owners would be at least two years behind in compounded increases lost.

Recently, the provincial government announced the rent freeze would come to an end on Jan. 1, 2022 and that inflation had been calculated at 1.5 per cent for purposes of annual rental increases.

B.C.’s maximum allowable rent increase is defined by the 12-month average per cent change in the all-items Consumer Price Index (CPI) for B.C. from July to July of the previous calendar year.

As there were several months of negative growth rates at the beginning of COVID-19, the newly announced average is lower than in more recent months.

For the last two years, owners of rental housing have borne exponential growth in expenses without the ability to recoup costs.

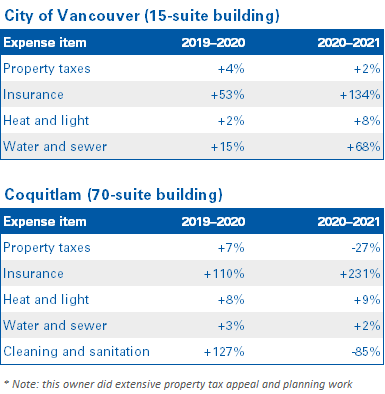

1.5 per cent is a drop in the bucket compared to the significant increases in costs that owners have faced; from two to 231 per cent for specific items as noted in our case studies below.

As an illustration, check out what one of our clients faced in expense increases in 2019–’20, contrasted with the additional 2020–’21 changes (extrapolated to year-end):

We question the 1.5 per cent proffered by the government, especially as many news outlets have asserted that Canada’s inflation rate is at its highest since 2003.

As reported by Yahoo Finance on Sept. 15, not only did inflation rise faster than expected in August, but the CPI rose 4.1 per cent on a year-over-year basis that month (exceeding the 3.9 per cent expected) and has been on its fastest pace since March 2003.

As we look to increase the supply of new market rental housing in B.C., barriers continue to be erected. An environment of lopsided rents vs. expenses will become a further disincentive to build.

We hope that municipal and provincial leaders will announce in the coming months how they’re planning to propel the delivery of desperately needed rental housing.

A happier note: Improvements eligible for higher rents

At least one recent announcement is positive for owners.

The ARI-C (additional rent increase for capital repairs), which is based on an owner’s payments to upgrade a significant building component, opened up for applications in July 2021.

You use it to calculate increases on your monthly rents. Capped at a maximum of three per cent per year, it’s amortized over a 10-year period. Check it out here.

To figure your average increases, visit the B.C. government’s calculator.

Mark Goodman and Cynthia Jagger are principals with Goodman Commercial in Vancouver. This article was originally published on The Goodman Report. It is reprinted by RENX with permission.