The raw data for our third-quarter 2022 market reports has been compiled and the findings are fascinating

The four main categories ― downtown and suburban office, retail and industrial sectors ― have all seen positive absorption since the last quarter.

It’s not hard to understand why when our provincial economy is firing on all cylinders, benefiting this year from strong market conditions for its essential commodities, food, fuel and fertilizer.

The latest manufacturing, retail and housing data show ongoing resilience, where Saskatchewan continues to outperform.

The provincial government has upgraded the 2022 budget significantly to a $1.04 billion surplus, mainly due to high potash and oil prices, and the subsequent increase in royalties.

The Conference Board of Canada states that Saskatchewan will lead all provinces in economic growth over the next two years, with a stunning 7.6 per cent expansion forecast in 2022.

Let’s take a glimpse at each sector.

Positive office absorption in third quarter

The overall office vacancy rate decreased to 15.11 per cent over the last quarter, with positive net absorption of 39,374 square feet.

The devil is in the details with a distinct difference between downtown and suburban office.

Our latest numbers show suburban office with 10.35 per cent vacancy and downtown with 19.72 per cent.

Most of the transactions we recorded in the suburban market for this last quarter ranged from 1,200 to 5,000 square feet.

The nine per cent difference between suburban and downtown office vacancy can be attributed at least partly to lower occupancy costs and more attractive parking options.

Retail remains stable, healthy vacancy rates

The retail sector recorded net positive absorption of 15,892 square feet resulting in a modest decrease in vacancy to 4.2 per cent.

The average asking net rental rate remained stable at $21.50 per square foot.

It’s interesting to note that RioCan Real Estate Investment Trust will report one of its best results for retail tenant occupancy in the third quarter, its chairman said, as Canadian consumers return to physical stores with COVID-19 restrictions removed.

“We’re finding that bricks-and-mortar retail is actually better in many ways than they were before the pandemic,” RioCan chairman Ed Sonshine said in an interview.

“Third-quarter numbers aren’t out there yet, but I know they will be pretty close, if not equal to, our all-time best as far as tenant occupancy.”

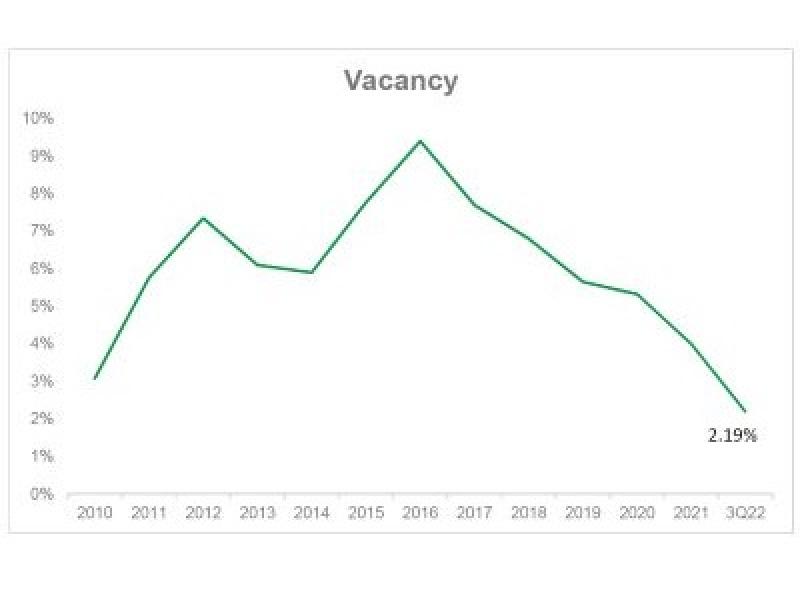

Record low industrial vacancy rates

We’re reporting 81,485 square feet of positive absorption for the third quarter, resulting in a new low of 2.19 per cent vacancy in the industrial sector. This compares with 2.52 per cent in the last quarter.

Tenants looking for existing industrial space are finding it increasingly difficult to find the right fit.

We continue to see robust demand from industrial owner occupants.

Recorded sales prices vary widely from $150 to over $300 per square foot (the percentage of land to building ratio can be one of the biggest factors influencing this large range in recorded sale prices).

This category of owner occupants appears to be unconcerned about rising interest rates.

My bet is on continued positive absorption in each one of these categories in the fourth quarter.