The Canadian commercial real estate market is undergoing a quiet recovery, characterized by stable overall capitalization rates (OCR), a continued flight to quality—particularly in well-located retail and residential assets—and divergent performance across sub-markets.

The Canadian economy and commercial real estate (CRE) sector are showing early but encouraging signs of recovery, setting the stage for a more favourable environment for lenders and borrowers alike. Easing inflation, improving liquidity conditions and a stabilizing macroeconomic outlook are supporting renewed investment activity. For lenders, this translates into increased demand for financing on well-located, income-stable assets—particularly in core markets like Vancouver and Toronto—where investor appetite remains strong. The stability of the OCR, holding firm at 5.89% in Q2 2025, signals a resilient market for core assets and a more predictable lending landscape.

Capital markets move forward, despite uncertainty

The Bank of Canada (BoC), along with the U.S. Federal Reserve (Fed), have held interest rate policy steady in recent months as they assess the impact of tariffs on inflation and economic growth. However, additional rate cuts are likely if inflation remains under control and economic conditions in both countries slow. Recent labour market reports from Statistics Canada and the U.S. Bureau of Labor Statistics point toward weaker employment conditions, which could prompt central banks to enact interest rate cuts this fall. The BoC’s Market Participants Survey indicated that financial markets anticipate two more rate cuts in 2025, likely to bring the overnight policy rate to 2.25% by year-end from its current position of 2.75%. Previous interest rate cuts have helped stabilize the CRE investment market, and further reductions would support a recovery in investment activity.

Earlier this year, CBRE’s Canadian Real Estate Lenders Report indicated improved sentiment among Canadian lenders, with over three-quarters of lenders surveyed reporting increased market liquidity and plans for higher originations in 2025. While trade turmoil in Q2 has given some lenders pause, improving market fundamentals have lowered lenders’ concerns regarding asset performance across some property types. Residential segments remain the most favoured, followed by retail and industrial, with hospitality experiencing strong, consistent sentiment improvements over the last four consecutive years. However, performance concerns still remain the highest in class-B office segments.

While overall CRE investment sales remain sluggish in Canada, there have been promising signs of recovery in the capital markets. Deal activity has continued, with investors focusing on top-tier assets, particularly in multi-family and retail. According to HVS’ in-depth Canada Hotel Valuation Index, strong operating performance is fueling transaction activity in hotel segments, further supported by Colliers INNvestment Canada Q2 2025 Mid-Year Report, which tracked nearly $1 billion in hotel sales Q2 year-to-date (YTD), led by major market transactions. Additionally, investor interest has also begun to improve in the office sector. Another positive indicator, according to the MSCI/RealPac survey, is that institutional investment returns have remained relatively stable over the past year, as at Q2 2025.

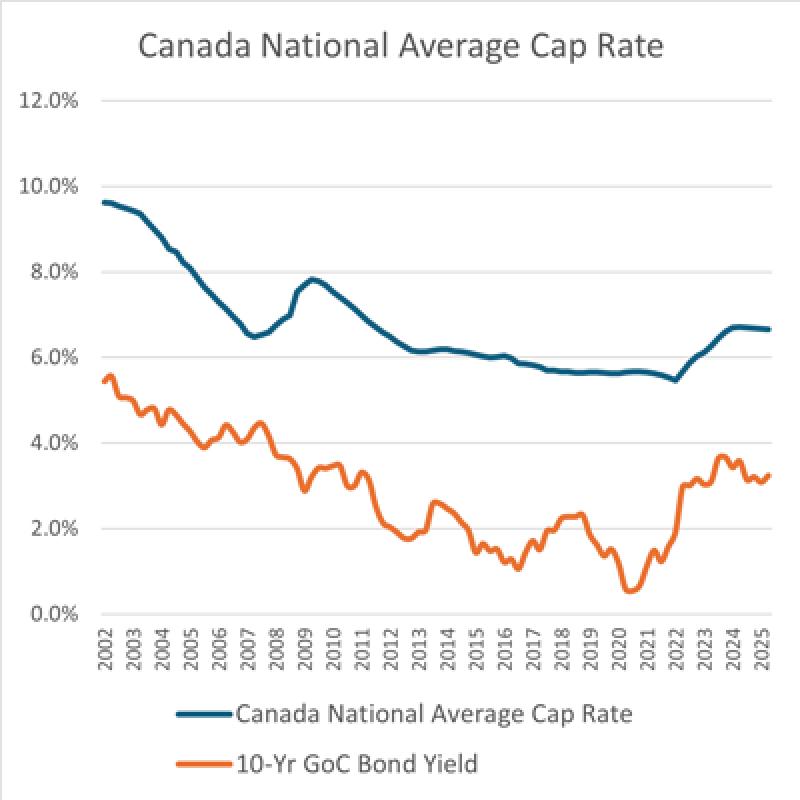

Commercial property pricing has stabilized, with the MSCI/Real Capital Analytics Canada Commercial Property Price Index (CPPI) up 0.8% for the year ended in Q2. Overall trends indicate that capitalization (cap) rates have stabilized near peak over the past several quarters, with the Canada all-property cap rate down 5 basis points (bps) year-over-year (YoY) to an average of 6.66% in Q2 2025. The Canada Cap Rates and Investment Insights Q2 2025 report by CBRE Canada Research indicates that cap rate movements across sectors have been limited during the first half of 2025, with slight increases observed in the industrial sector, while modest declines have been noted in the office, retail and multi-family sectors. These trends are likely to continue over the second half of 2025, with an anticipated gradual improvement in liquidity and financing conditions.

Residential remains a strategic investment

Residential investments are often viewed as a defensive investment play in challenging economic times. In Canada’s case, notwithstanding some near-term softness in asking rents for select urban centres—most notably Metro Vancouver and the Greater Toronto Area (GTA)—long-term forces have created an undersupply in multi-family rental markets. A combination of limited construction and strong immigration pushed the national apartment vacancy below 3.0% over the past three years—ending 2024 at 2.7%—with rents increasing by an average of 7.4% per annum over this period, according to combined data from the Canada Mortgage and Housing Corporation (CMHC) and CBRE Research.

In recent months, the acute shortage of purpose-built rental apartments has begun to ease, reflecting reduced immigration, decreased international student visas and federal initiatives aimed at boosting new supply. Over the first half of 2025, Statistics Canada and CMHC reported that purpose-built rental construction starts reached 73,700 units, representing a 2.4% increase from the same period in 2024. In its mid-year review, CMHC noted easing headline rents and increased concessions, particularly in Calgary, Toronto and Vancouver. CMHC’s Summer Housing Outlook calls for modest increases in apartment vacancy in 2025 across the major markets, followed by slowing construction in 2026. Rents are expected to increase modestly across major markets.

As the Canadian housing market undergoes a short-term recalibration, persistent affordability challenges in the for-sale segment continue to drive strong investor demand for rental apartments—presenting a compelling opportunity for both lenders and borrowers. Elevated cap rates, still near recent cycle highs, are creating entry points to acquire multi-family assets at valuations below recent peak levels. This dynamic supports the case for financing well-located, stabilized apartment properties with durable income potential. According to the BoC, the typical household needed to spend over 45.0% of income to purchase a median-priced home in Q1 2025—down from nearly 55.0% in 2023, yet still well above long-term affordability benchmarks. As a result, the structural demand for rental housing remains intact.

Evolving markets, enduring fundamentals

While trade and macroeconomic challenges are expected to linger through the second half of 2025, favourable market pricing trends and improving capital market conditions continue to support a cautiously optimistic outlook. We are seeing opportunities emerge across the industrial and multi-family sectors, driven by evolving space needs, shifting investor strategies and a sustained flight to quality. In line with the market’s quiet recovery, evidenced by stable cap rates and renewed investor focus on well-located, income-generating assets, the Canadian CRE sector remains resilient. Long-term demand fundamentals and ongoing structural transformation across key asset classes will continue to shape the next phase of the cycle.