Recent Articles

Chinese investors snag Bentall Centre towers

Chinese investors snag Bentall Centre towers

Chinese investors have won one of the most important commercial real estate auctions in Vancouver history, swooping in to grab a controlling interest in all four towers of the Bentall Centre. Anbang Insurance Group Co. Ltd., is buying a 66 per cent stake in Bentall I, II, III and IV — a commercial 1.5-million-square-foot office complex, with some retail.

Dream Office REIT properties for sale

In a stunning strategic shift for one of Canada’s largest office tower owners, Dream Office REIT (D.UN-T) is slashing its distribution and putting $1.2 billion worth of properties on the block. Emerging from the financial crisis, Dream Office was heralded as one of Canada’s top-tier REITs, with deals like the joint acquisition of Scotia Plaza for $1.3 billion.

Globe and Mail (Subscription Required)

Development charges high on REALpac’s 2016 agenda

National industry group REALpac has a busy slate of activities for 2016, but taxes (and bureaucratic red tape) are the one subject sure to elicit a reaction from CEO Michael Brooks.

Strathallen builds investment capacity, buys Nortown Centre

Strathallen Capital continued to build its investment capacity with the recently closing of its fourth closed-ended Canadian retail value-add property fund. Strathallen Capital Corp. recently raised $250 million for its Retail Property Fund Limited Partnership No. 4 which is co-invested by Canadian institutional investors and Strathallen partners.

CPPIB, Welltower JV on Florida retirement properties

The CPP Investment Board and Welltower Inc. (HCN-N) of Toledo, Ohio, are jointly buying six seniors housing properties in Florida for $764 million Cdn. The Toronto-based retirement fund manager will own 45 per cent of a new joint venture that will buy the Aston Gardens properties, which have a total of 1,930 rental units in low-rise buildings.

Globe and Mail – IPE Real Estate – Globe and Mail (Subscription Required) – Asian Pacific Post

CT announces sale, leaseback of distribution centre

CT Real Estate Investment Trust (CRT.UN-T) announced it has reached an agreement with Canadian Tire Corporation, Limited for the sale and leaseback of the Canadian Tire Distribution Centre, nearing completion in Bolton, Ont. The 1.4 million-square foot-facility and 81 acres of trailer parking represents a total investment of $325 million.

Sonshine signs extension as RioCan REIT CEO

RioCan Real Estate Investment Trust (REI.UN-T) announced RioCan’s Board of Trustees has approved and CEO Edward Sonshine has accepted an amendment to his employment contract. Under the amended contract, Sonshine has agreed to a commitment to remain CEO of the REIT until at least December 2018.

Northview Apartment announces CFO’s resignation

Northview Apartment REIT (NVU.UN-T) announced the resignation of Robert Palmer, chief financial officer, effective March 9, following the release of 2015 year-end results, to accept a position at another company. Northview has commenced a search for Palmer’s replacement.

Sutton in charge at True North Square

A luxury hotel chain, whose parent company has business ties with True North Sports & Entertainment, will be developing and managing the new hotel that will be part of downtown Winnipeg’s $400-million True North Square development. A source confirmed Thursday Vancouver-based Sutton Place Hotels will be developing and managing the True North Square hotel.

Edmonton’s Northlands hopes to reinvent itself

Edmonton’s Northlands plans to reinvent itself as a national sports tournament and festival centre, if it gets approval and funding for $165 million in renovations. The proposal includes major renovations to all three of its principle buildings to create a multiplex with seven ice surfaces, an outdoor festival and concert space and a 5,000 seat multi-purpose venue.

CBC News – Edmonton Journal – Edmonton Journal – Edmonton Journal

Edmonton’s Associated Engineering moves to new HQ

A low-key Edmonton engineering firm marking its 70th anniversary this year is officially opening its new headquarters Thursday back downtown where the company began. Associated Engineering was started in 1946 by three Second World War veterans president Kerry Rudd says in the firm’s seventh-floor boardroom at 9Triple8 Jasper.

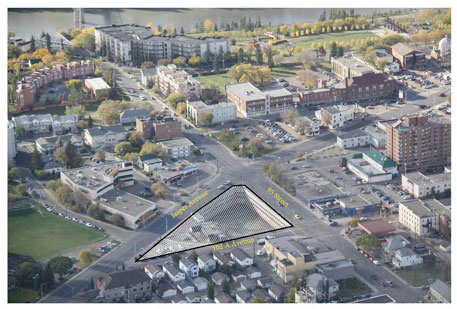

| Development site for sale in downtown Edmonton |

| The City of Edmonton is inviting applications to purchase a prominent high density mixed-use development site, comprising 0.84 acres of developable land, located at the intersection of Jasper Avenue and 95 Street. Open for offers until 4pm, March 23, 2016.

Detailed information package is available at: www.edmonton.ca/propertysales Phone: 780-496-6000 |

As hedge funds struggle, REIT become victims

Hedge funds that piled into REITS are hurting the companies on their way out. REITs that have had a relatively large portion of hedge fund owners are struggling with declining stock prices. NorthStar Realty Finance Corp. (NRF-N) is one of the two worst performers this year in a Bloomberg index of 41 mortgage REITs, with a 39 per cent decline.

Canadian Tire eyes e-commerce for growth

The next acquisition for Canadian Tire Corp. Ltd. (CTC-T) will likely be in e-commerce, says the head of the national retailer. “We set a path for ourselves to be a leader in e-commerce in Canada and that’s where we’re heading,” president and CEO Michael Medline told analysts during a call Thursday following the company’s latest quarterly results.

Montreal Gazette – Globe and Mail – Financial Post

Wal-Mart still outshone by Amazon.com

Despite spending billions on its Web operations to take on rival Amazon.com Inc., (AMZN-Q), Wal-Mart Stores Inc. (WMT-N) Thursday told investors online sales momentum was slowing. The world’s biggest retailer said e-commerce sales rose only eight per cent in the fourth quarter, down from 10 per cent in the third quarter and 16 in the second.

Bloomberg – Reuters – Toronto Star – Reuters

‘No deterioration’ in NYC office market: Vornado CEO

Chair/CEO Steven Roth said Vornado Realty Trust (VNO-N) sees “no deterioration in the New York office business” ahead despite concerns over slowing job growth in the city and rising economic uncertainty. The city’s office leasing economy “benefits from an enormously diverse business community” that insulates it from depending on any one industry, Roth said.

Market Trends and Research

Wealthy heavily focused on real estate

With markets roiling in 2016 and commodities lingering in low-price limbo, the holdings of high-net-worth investors can serve as indicators of where the rest of us might consider parking our nest eggs. It turns out a good chunk of wealthy peoples’ investments is in real estate, says Simon Jochlin, portfolio analytics associate at Stenner Zohny Investment Partners.

Airbnb – If you can’t beat ‘em, join ‘em?

As Airbnb reshapes the future of real estate, some multi-res and hospitality participants appear to be moving from resistance to acceptance of the short-term rental industry giant. As they continue to feel its disruptive impact, some REITs and other landlords are wondering, “If we can’t beat them, why not join them?”

GTA office vacancy rates edged up in 2015: NKF

In its Real Estate Market Study, Newmark Knight Frank Devencore reported combined class-A and class-B office vacancy rates in downtown Toronto rose from 4.8% to 5.0% over the course of 2015. Much of the increase was attributable to the new buildings added to the total inventory during the year.

CRE giant CEOs optimistic about 2016

The largest publicly traded commercial real estate services companies expect the strong market conditions that have buoyed property values and attracted record levels of investment to carry over into this year. CBRE Group, JLL, and Colliers International all reported improved margins and strong revenue growth in 2015.

REOC Financial Reports

Latest fourth-quarter reports:

* Fairfax Financial Holdings Ltd., (FFH-T), Bloomberg, Reuters

* First Capital Realty Inc., (FCR-T), Canada Newswire

REIT Financial Reports

Latest fourth-quarter reports:

* Boardwalk REIT, (BEI.UN-T), Canada Newswire

* Choice Properties REIT, (CHP.UN-T), Canada Newswire

* Dream Global REIT, (DRG.UN-T) Marketwired

* Dream Office REIT, (D.UN-T) Marketwired

* Morguard REIT, (MRT.UN-T), Canada Newswire

* RioCan REIT, (REI.UN-T), Marketwired

Real Estate Investment Trusts

Stephenson CEO likes Slate Retail

Slate Retail REIT (SRT.UN-T) is a Canadian retail REIT focused exclusively on U.S. grocery-anchored retail centres in large but secondary markets. In essence. this is a growth through acquisitions strategy.

A flight to quality REIT portfolio

The financial crises of 2008 raised new concerns about the operation of financial markets. That period of time was clearly a “black swan” event as investors were taking excessive risk that resulted in a catastrophic financial meltdown. This sudden shift in investor sentiment was drastic as most every financial sector participant felt the pain.

There’s money in Zell’s mobile home park REIT

One of the reasons Sam Zell is America’s sixth-richest real estate mogul is he sees opportunities in sectors other investors avoid. An example: Equity LifeStyle Properties (ELS-N), the Zell-led REIT that puts major skin in mobile home and RV parks. Equity LifeStyle posted an all-time high in early February, making it one of the strongest-performing REITs.

U.S. REITs projected to be big net sellers in 2016

A review of acquisition and disposition activity for 2016 finds a majority of the nation’s publicly traded REITs and real estate companies expect to be big sellers of properties this year, with the projected total of property dispositions more than double that of acquisitions. In addition, three times as many REITs are projecting to be net sellers compared to net buyers in 2016.

Retail

Nordstrom profit misses estimates

Department store operator Nordstrom Inc. (JWN-N) reported a lower-than-expected quarterly profit as it was forced to discount more to clear excess inventory from the holiday season, sending its shares down more than eight per cent in extended trading. The company also said it would cut $300 million US from its capital spending of $4.3 billion over the next five years.

Canada retail sales plummet in December

Canadian retail sales fell at the fastest pace in more than five years in December, on reduced holiday shopping and as a late start to winter snowfall curbed vehicle purchases. Sales decreased 2.2 per cent to $43.2 billion, Statistics Canada said Friday. The decline exceeded all 20 forecasts in a Bloomberg News survey.

New Development

Edmonton project could see sales by June

An Edmonton eyesore may soon be no more. Concept drawings of an urban plaza with shops and condos are just part of a request coming before council next month to rezone land known as the West Block project. The site’s foundations are the only visible work since 2014 when the company behind it underwent “restructuring and financing.”

Infrastructure

Ontario Infrastructure investment ‘well below’ optimum: CANCEA

A new report by the Canadian Centre for Economic Analysis (CANCEA) shows an imbalance in infrastructure investment levels in Ontario by tier of government (federal, provincial and municipal) continues to exist, and that investment remains below what the economy needs to support its best chance of success.

Daily Commercial News – Globe and Mail

Montreal opens wallet for roads, waterworks

Montreal spent a record $445 million to repair and improve roads and water infrastructure in 2015. And officials warned motorists and merchants Thursday that it’s going to get worse before it gets better. “There is no doubt there is a lot of work that still needs to be done,” said Lionel Perez, a member of Montreal’s executive committee.

Colorado’s battle over tax limits could shape future growth

By 2030, Colorado’s population will grow from five million to seven million, thanks in part to a strong and diverse economy, the state’s famed Rocky Mountain quality of life, and its constitutionally-mandated low taxes. And because of those voter-sanctioned tax limits, the fast-growing state could someday fall victim to its own success.

Human Resources

Genesis announces management changes

The Board of Directors of Genesis Land Development Corp. (GDC-T) announced Bruce Rudichuk has left the company as president and chief executive officer effective immediately. In addition, Mark Scotthas left the company as executive vice-president and chief financial officer effective immediately.

Other

|

RENX has surpassed 8,785 Twitter followers |

| Follower Condo Directors Group formed by and for condo directors to help them manage their Condo operations by leveraging their knowledge, skills and experience. | |

| Follow RENXca, the most comprehensive news feed on Twitter for Canadian real estate professionals. |

Industry Events

Industry Events

-

CRE.Converge 2025

Sep 08 2025

to Sep 10 2025

Sheraton Centre Toronto

-

RealREIT

Sep 10 2025

Metro Toronto Convention Centre

-

Canadian Apartment Investment Conference

Sep 11 2025

Metro Toronto Convention Centre

-

BOMEX Halifax 2025

Sep 15 2025

to Sep 17 2025

Halifax Convention Centre

-

Montréal du Futur

Sep 24 2025

to Sep 29 2025

World Trade Centre of Montreal