There were differing opinions on the state of real estate investment trusts during the closing roundtable session of RealREIT at the Metro Toronto Convention Centre, after an earlier session reviewed the performance of Canadian trusts.

“I'd say the public market REIT space is broken right now,” Nexus Industrial REIT chief executive officer Kelly Hanczyk said during the roundtable at the Sept. 10 event. “In an efficient market, our stock’s not trading at $7.60 when our NAV (net asset value) is $13.17.”

Hanczyk believes the Canadian REIT space will get smaller since there’s a lot of private equity money from investors that will look at the discounted values and purchase the REITs outright.

Hanczyk doesn’t see that happening with Nexus, however, since it has two major shareholders that are vested in the REIT and aren’t looking to get out.

RioCan’s CEO loves REITs

RioCan president and CEO Jonathan Gitlin offered a different opinion of REITs during the roundtable, even though units of his trust have also been trading well below NAV, prompting it to buy back a lot of its own shares.

“I love the REIT model,” Gitlin said, adding that REITs can provide stable cash flows to people who otherwise wouldn’t be able to invest in commercial real estate. “It's frustrating to see us trade below NAV consistently for the last little while, but there's a ton of noise around this space and I think it supports real value.”

Gitlin believes the public market will eventually realize the value of REITs and their assets. He conceded, however, the sector has lost the attention of capital markets to companies like NVIDIA, which has seen its stock price more than double to the US$180 range over the past year — creating a market cap of U.S.$4.32 trillion.

RioCan, in comparison, has a market cap of about $5.57 billion. Nexus’ market cap is approximately $750 million.

“There’s a focus on these massive capital appreciation returns, but the market will again at some point focus on the consistent, tax-efficient returns that we provide,” Gitlin said. “I think the real estate that Canadian REITs own is irreplaceable and in a great country which is very stable.”

Discounts to NAV are up

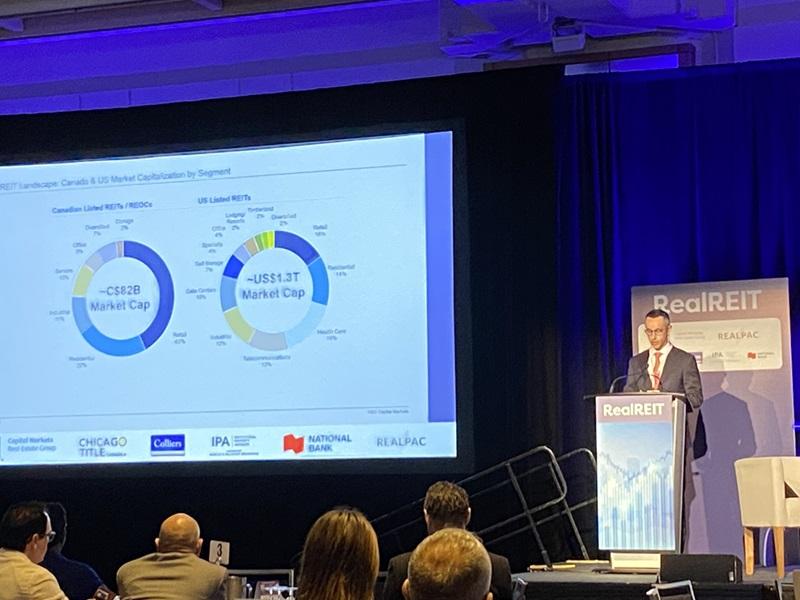

David Holden, the managing director and co-head of Canadian real estate investment banking for RBC Capital Markets Real Estate Group, earlier presented an overview of the Canadian REIT market.

“While the recovery in the sector from the lows of 2023 has helped somewhat, the sector still trades at an estimated 14 per cent discount to NAV,” Holden noted. “This discount compares to the long-term average discount of two per cent and the last 10-year average discount of 11 per cent.”

Since this time last year, the aggregate Canadian REIT market cap has decreased by $3 billion to $76 billion and remains well below the all-time high of $101 billion.

Canadian REITs bought back more than $1 billion worth of their units over the past 12 months, with the largest participants being CAPREIT, Granite REIT, RioCan, InterRent and Primaris.

REIT returns

Thirty-six Canadian REITs delivered positive total returns over the past 12 months, which was unchanged from the prior year.

The Toronto Stock Exchange (TSX) index delivered a 27 per cent total return, driven by strong performances from the technology, materials and financial sub-sectors. The TSX REIT index provided a three per cent return.

Seniors housing REITs delivered a 34 per cent return after a 46 per cent return in the comparable period last year. Diversified and office REITs had 15 per cent returns, followed by retail at nine per cent, industrial at minus three per cent and residential at minus five per cent.

Since this time last year, 20 REITs increased their distribution while one issued a cut. That compares to 13 increases and eight cuts last year. The weighted average yield at the end of August was 4.9 per cent, which was largely unchanged from last year.

Outlook for REITs

“Operating performance remains healthy,” Holden said when describing the big picture for Canadian REITs. “Leverage is declining and liquidity is robust. Interest rates have stabilized at a constructive level for real estate investment.”

The Canadian bond market loves REITs, Holden added.

“This gives one hope that there's room for REITs to trade higher going forward as capital rotates back to our sector,” he said. “The alternative could be more privatization activity or perhaps a change in how people access REITs.”

Ending his presentation on a positive note, Holden pointed out the TSX REIT index has delivered a compounded average return of 9.4 per cent, better than the TSX index return of seven per cent.

REITs came and went

Go Residential entered the Canadian REIT market this year with an initial public offering (IPO) of US$410 million on the TSX and a portfolio of five luxury high-rise apartment buildings with a combined 2,015 suites in New York City. It was the largest REIT IPO ever in Canada.

“It's following a path that has been well-tread by many U.S. residential entities,” Holden said. “These entities were attracted to our market owing to a very supportive investor base and banking community.”

Canada also lost three REITs this year (not including the Sept. 15 announcement that Artis REIT will merge with RFA Capital into a publicly traded entity to be known as RFA Financial).

Melcor Developments Inc. acquired its approximately 45 per cent unowned equity interest in Melcor REIT Limited Partnership in April at a price of $5.50 per unit, which equated to a 62 per cent premium of its share price at the time the plan was announced.

Though the deal isn’t expected to close until late this year, CLV Group and Singapore’s GIC sovereign wealth fund agreed to acquire InterRent in a cash deal which valued the trust at about $4 billion in May. That represented a 35 per cent premium.

An affiliate of U.S.-based Morgan Properties agreed to acquire Dream Residential REIT for approximately $491 million in an all-cash transaction in August. The deal hasn’t yet closed, but the price represented a 60 per cent premium.