(Courtesy Goodman Commercial)

GUEST SUBMISSION: At Goodman Commercial, we spend most of our collective time listing and selling commercial real estate. That said, we also take pride in the information, statistics and trends we compile and communicate to our readers.

So diving in, here’s the latest thing we’ve been noticing over the last month. Three separate builders have independently told us about the community amenity charge (CAC) process they’ve been thrust into for proposed rental projects in the City of Vancouver.

This represents several development sites which were purchased over the past few years. These much-needed rental units could ultimately end up on the sideline as unexpected costs could render these rental developments infeasible.

If you keep up with housing news in Vancouver, you’re familiar with negotiated CACs as an aspect of the condo market.

The processes can be inconsistent and brutal. They involve multiple departments, pro forma reviews and lump-sum payments suddenly added to the cost estimates of projects.

If these costs are set rates known at the time of land acquisition (say, cost per square foot), then they can be accounted for. However, adding a significant cost sometimes amounting to millions near the beginning of construction can make a project, especially a rental, dead in the water.

Not long ago, a policy paper from the City of Vancouver stated clearly that 100% rental projects wouldn’t be subject to CACs in specific areas. See the link here.

Where we stand today on CAC charges

The reasoning was included in the city paper from 2017:

“It is recommended that the CAC process be streamlined so that routine, lower density rental rezoning applications (outside the Downtown) be exempt from CACs. This approach would enable a majority of rental rezoning projects to proceed without a CAC and free rezoning applications from participating in the City’s negotiated CAC process while also having the added benefit of allowing staff more time to work on complex, larger rezoning applications.”

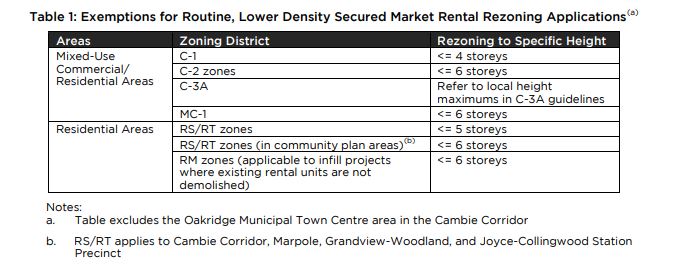

The tide seems to be turning based upon our discussions and with CACs being imposed for rentals in some cases. Here is the updated policy paper from February 2021 which shows some areas do remain exempt:

In 2020, only 896 rental units were completed in the City of Vancouver within a universe of 59,453 existing. Adding 1.5 per cent to the existing purpose-built stock won’t move the dial on vacancy and rental rates long-term. We know we need more rental housing – is a long-winded and negotiated process really a good idea?

Politicians need to be aware that we’ve been operating in a unique period when the stars have aligned for rental construction. Higher rents, lower cap rates, low interest rates and some government policies have helped.

However, a further rationalization has involved the pre-sale market slump for new condo projects that have turned the attention of many builders to rental to continue to operate and keep staff employed.

A new downturn in rental housing starts?

Now, given the returning strength of the pre-sale market and costs escalating, we would not be surprised to see many rental projects either stall out or convert back to condo if the numbers are tight.

A shift in perspective is needed. The incentives that worked before may not work now or in the future. Where rental is concerned, better to overdo incentives than under.

Recommendations:

– Get new rental policies out and working – more density will be needed.

– Clear the backlog – thousands of units are stuck.

– Provide early and consistent communication about anticipated costs.

– If a new cost is added, grandfather projects already in process.

– Pre-zone if possible.

What are your thoughts? Send us your comments at info@goodmanreport.com

EDITOR’S NOTE: This Op Ed article originally appeared in the Goodman Report. It is republished with permission. The article was also updated after publishing to correct a typo from the source. The number of apartments completed in 2020 actually represents 1.5 per cent of the total stock.