Recent Articles

Dogwood development to transform Cambie Corridor

Dogwood development to transform Cambie Corridor

A double-barrelled, $302-million land deal that began in 2015 represents the Onni Group’s largest B.C. project and might be a model for a private-public sector development in Vancouver. It represents a multimillion-dollar construction play that will see a string of residential towers erected along Vancouver’s Cambie corridor, new medical and recreational facilities and a SkyTrain station.

Brookfield closes on Royal Centre sale

Canadian real estate giant Brookfield Canada Office Properties (BOX.UN-T) announced it has closed a deal to sell its Royal Centre office tower, at the corner of Burrard and West Georgia streets, for $285 million in net proceeds. The assessed price for the 589,000-square-foot, 37-storey office tower, which also has 91,000 square feet of retail space, was $287.5 million.

Crown, Crestpoint buy Allstate Corporate Centre

Crown Realty Partners and Crestpoint Real Estate Investments Ltd. have assumed joint ownership of the Allstate Corporate Centre in Markham, Ont. The two companies split the $148.55-million purchase price in acquiring the property from British Columbia Investment Management Corporation.

Partners REIT turns back on past

Partners Real Estate Investment Trust (PAR.UN-T) has faced a couple of challenging years with corporate issues and restructuring, but president and chief executive officer Jane Domenico seems confident it’s turned the corner. “Our focus has been on growth in our net operating income and occupancy, even if we haven’t been able to have an accretive acquisition,” she said.

MGM Resorts pulls trigger on mega-REIT

MGM Growth Properties LLC, MGM Resorts International’s new real estate subsidiary, filed a registration statement for an initial public offering last week. The MGM Resorts (MGM-N) properties that will be under the new entity’s ownership will comprise seven properties on the Las Vegas Strip (six resorts and an eight-acre dining and entertainment complex, The Park.)

Fairfax to buy Bangalore Airport stake

Indian airport operator GVK Power & Infrastructure Ltd. said it sold a stake in its Bengaluru aerodrome to Fairfax Financial Holdings Ltd., helping cut debt. Fairfax (FFH-T) will buy 33 per cent of Bangalore International Airport Ltd. for $426 million Cdn, GVK said in a statement to the Mumbai stock exchange Monday.

Bloomberg – Reuters – Vancouver Province

Oregon PERF invests in Brookfield infrastructure fund

The Oregon Public Employees Retirement Fund (Oregon PERF) is backing Brookfield Asset Management’s (BAM.A-T) third infrastructure fund with $400 million US. Brookfield is aiming to raise $10 billion, with a hard cap of $12 billion for the global fund. The manager’s previous fund, Infrastructure Fund II, raised $7 billion in 2013.

Boardwalk remains optimistic about Alberta

Calgary-based Boardwalk REIT (BEI.UN-T) continues to build and buy despite Alberta’s current economic woes. Are we going to sell some of our Alberta stuff? No, we think it is a great market to be in. We have been here before,” said Boardwalk president Roberto Geremia.

Property Biz Canada – Property Biz Canada

Manasc Isaac opens first foreign office

Edmonton architects Manasc Isaac picked somewhere similar to home but far away for their first office outside the province — they’ve started an operation in Romania. Two architects from the Eastern European nation’s capital, Bucharest, have returned home to launch Latitudine53 by Manasc Isaac after working for the firm in Edmonton and Calgary for the last two years.

Edmonton Journal – Canadian Architect

Chinese investment could make Terrace a hub

What seemed like a simple sale of industrial land in Terrace, B.C., in July 2014 has the potential to be so much more. Burnaby-based Taisheng International Investment Services officials said last week environmental studies and site planning are well underway for their planned development the property at Terrace’s Skeena Industrial Development Park.

China’s Anbang raises offer for Starwood

China’s Anbang Insurance Group Co has raised its offer for Starwood Hotels & Resorts Worldwide Inc (HOT-N) to almost $18.5 billion Cdn in its latest challenge to the U.S. hotel operator’s merger with Marriott International Inc (MAR-Q). The acquisition of Starwood by Anbang would be the largest ever by a Chinese company in the U.S.

Reuters – Winnipeg Free Press – CoStar Group – Globest.com

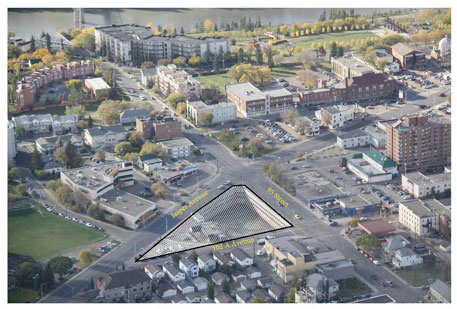

| Development site for sale in downtown Edmonton |

| The City of Edmonton is inviting applications to purchase a prominent high density mixed-use development site, comprising 0.84 acres of developable land, located at the intersection of Jasper Avenue and 95 Street. Open for offers until 4pm, March 23, 2016.

Detailed information package is available at: www.edmonton.ca/propertysales Phone: 780-496-6000 |

How to revitalize downtown Winnipeg

Building a prosperous downtown is a two-way street — literally. Later this year, downtown Winnipeg will celebrate its 60th anniversary of becoming a one-way city. Our transition away from urban two-way streets began some 30 years earlier, however, as car ownership grew, and for the first time traffic flows started to become a public concern.

Behind the scenes of a fitness industry giant

A man walked into the Nautilus gym in Hayward, Calif., to speak with owner Leonard Schlemm and his business partner, Mark Mastrov, about buying the club. To show he was serious, the man opened up a briefcase packed with diamonds. “Leonard took one look and said, ‘These diamonds aren’t worth anything,’ ” Mastrov said.

Real estate mogul bounced back from bankruptcy

Framed head shots of some famous faces ring David Lichtenstein’s office — including the mugs of Steve Jobs and Jeff Bezos. Those two and Lichtenstein have something in common: They rose from modest beginnings to amass 10-digit fortunes. “I’m just a normal guy,” insists the bespectacled Lichtenstein, 55, in his thick Brooklyn accent.

Bigger is better for Singapore REITs facing consolidation

Singapore’s REIT market is set to consolidate as smaller vehicles merge to cope with rising regulatory costs, according to Cambridge Industrial Trust. “The wave of consolidation for Singapore REITs is about to begin,” Philip Levinson, chief executive officer at Singapore-listed Cambridge Industrial, said.

Featured Column

The MPAC deadline: Pay attention now, or pay me later

The MPAC deadline: Pay attention now, or pay me later

Commercial landlords in Ontario, don’t forget the return you’re expected to file by March 31, the 2016 Property Income and Expense Return, for MPAC.

The challenges of a sublease

The challenges of a sublease

We as agents often take for granted that tenants and landlords understand the terms that relate to leasing and selling commercial real estate. One such common clause is that of subleasing.

Market Trends and Research

Saudi land purchases fuel debate over U.S. water rights

Saudi Arabia’s largest dairy company will soon be unable to farm alfalfa in its own parched country to feed its 170,000 cows, so it’s turning to an unlikely place to grow the water-chugging crop — the drought-stricken American Southwest. Almarai Co. bought land in January that roughly doubled its holdings in California’s Palo Verde Valley.

Las Vegas CRE market returning to normalcy

Those in the know in Las Vegas’ commercial real estate industry say they are cautiously optimistic about the performance of their industry in 2016. Michael Newman, managing director of the Las Vegas office of CBRE Group, recently weighed in on where commercial real estate in Las Vegas appears to be heading.

Real Estate Companies

Air Canada may move maintenance centres

Prime Minister Justin Trudeau’s government is loosening the legal shackles on Air Canada (AC-T) by easing its maintenance requirements after the country’s biggest carrier agreed to buy jets from struggling manufacturer Bombardier Inc. The changes introduced Thursday will allow Air Canada to move its maintenance centres within three provinces and change employment levels.

Online property companies soar on China’s recovery

Real estate Web portals Leju Holdings Ltd. and SouFun Holdings Ltd. are standing out among U.S.-traded Chinese stocks, rebounding as government stimulus and a recovering property market improves the outlook for growth. Leju has surged 44 per cent over the past month in the best performance on the Bloomberg China-US Equity Index.

New ROM CEO to roll out the welcome mat

The Royal Ontario Museum and its new CEO, Joshua Basseches, seem made for each other. The place needs a shakeup and a way into the 21st century, and he comes across as the charismatic and articulate makeover expert to lead a transformation. He starts work Tuesday at a (relatively modest) salary of $380,000.

REOC Financial Reports

Latest fourth-quarter report:

* Firm Capital Property Trust, (FCD.UN-X), Canada Newswire

REIT Financial Reports

Latest fourth-quarter report:

* WPT Industrial REIT, (WIR.U-T), Canada Newswire

Real Estate Investment Trusts

Collect monthly rent from Smart REIT

Investors can get great yields from REITs without the hassle of owning property. Here’s how any investor can collect $1,000 per month in rent from Smart REIT (SRU.UN-T) without setting foot in a physical property. There are many reasons to own Smart REIT over a condo.

Sun buys another MH REIT

Sun Communities Inc. (SUI-N) said Tuesday it would acquire fellow manufactured housing REIT Carefree Communities Inc. from Centerbridge Capital Partners for $1.68 billion in cash and stock. The deal will make SUI the premier publicly traded REIT in the manufactured housing and RV community space, enlarging its portfolio by more than 40 per cent.

Avoid the private REIT: Opinion

A private REIT actually looks and smells like a limited partnership. Usually, all the money needed for the investment is raised on the front end. Since the shares are not listed on an exchange, once you are in it’s very hard to get out. You often don’t know the full extent of the properties the REIT will purchase, and they often are not as diversified as their publicly traded cousins.

Legal Corner

Costco probed in alleged drug kickback scheme

Costco (COST-Q) is under investigation for an alleged kickback scheme where it demanded a drug company pay more than a million dollars to get its medications stocked at its pharmacies. The Ontario College of Pharmacists began its probe after a sales rep for generic drugmaker Ranbaxy filed a complaint accusing Costco of squeezing out nearly $1.3 million in unlawful rebates.

Retail

MEC adding second store in South Edmonton Common

The popular MEC outdoor store is opening a second local store in South Edmonton Common this fall. The new 35,000-square-foot outlet will be about 30 per cent bigger than the current store on 102nd Avenue, chief financial officer Sandy Treagus said Thursday.

Restaurants and Eateries

Times changing for Winnipeg blues club

The iconic Times Change(d) High and Lonesome Club is entering a new era. A post on the popular downtown blues club’s Facebook page on Saturday announced the club’s ownership in partnership with John Pollard, co-CEO of Pollard Banknote, will “take possession of the Fortune Block” in the 200 block of Main Street on April 5.

Yum in talks to sell stake in China unit

Yum Brands Inc (YUM-N), owner of KFC and Pizza Hut, is in talks with private equity firms including KKR & Co LP (KKR-N) and Hopu Investments to sell a minority stake in its China operations as it prepares to spin off the once booming unit, two sources said. Several other Chinese investors were also looking into the deal, said the sources.

New Development

Second development touted for Edmonton intersection

A company wants to redevelop Edmonton’s derelict Blue Chicago site on Stony Plain Road and 142 Street, potentially the second major project for the key intersection. Alldritt Land Corp. is notifying nearby residents it plans to apply for rezoning of the intersection’s southwest corner. The development site also includes several homes south of the Blue Chicago.

Mixed-use tower proposed for Edmonton

Central McDougall residents have questions about a proposed residential tower across 111 Avenue from the now-closed Edmonton Petroleum Club. The 14-storey building will have commercial space on the ground floor and housing above, according to a city planning report. The vacant property is owned by a numbered company.

Resorts

Dubai to add Six Flags to resort

A massive Dubai amusement park project still under construction plans a $454-million US addition to include a Six Flags. The new spending by Dubai Parks & Resorts, which already includes Bollywood and movie-themed parks, as well as a Legoland, will put the cost of the entire project at well over $3 billion US.

Other

|

RENX has surpassed 8,875 Twitter followers |

| Follower Bonneville Multifamily Capital specialized in multifamily USDA and HUD/FHA loans. Based in Salt Lake City, UT it is the largest USDA lender in the country. | |

| Follow RENXca, the most comprehensive news feed on Twitter for Canadian real estate professionals. |

Industry Events

Industry Events

-

CRE.Converge 2025

Sep 08 2025

to Sep 10 2025

Sheraton Centre Toronto

-

RealREIT

Sep 10 2025

Metro Toronto Convention Centre

-

Canadian Apartment Investment Conference

Sep 11 2025

Metro Toronto Convention Centre

-

BOMEX Halifax 2025

Sep 15 2025

to Sep 17 2025

Halifax Convention Centre

-

Montréal du Futur

Sep 24 2025

to Sep 29 2025

World Trade Centre of Montreal