There is lots of chatter on the street with the recently released preliminary budget from the City of Saskatoon, which proposes a 4.5 per cent property tax hike in 2019.

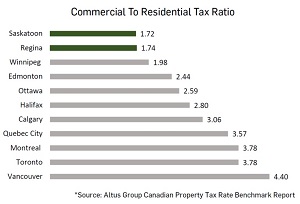

Commercial to residential property tax ratios in major Canadian cities in 2018. (Graphic courtesy ICR Commercial, data courtesy Altus Group.)

That chatter is incomplete without stepping back and looking at a couple of key issues.

Those two issues are residential and commercial tax ratios, and the ongoing cost of city infrastructure growth.

Commercial to residential tax ratios

The Canadian Property Tax Rate Benchmark Report released by Altus Group, and supporting partner REALPAC, states Saskatoon and Regina have the lowest commercial to residential tax ratios of major Canadian cities at 1.72 and 1.74, respectively. (For a full-sized image of the tax ratios graphic, click this link)

Here’s an example to explain what this ratio means: the average ratio of the 11 cities in the report was 2.9. A residential property valued at $1 million would incur taxes that were 2.9 times less than a commercial property of that same $1 million value.

The report states, “Lower commercial property taxes help make cities more competitive, promote job growth and investment, and subsequently generate more stable and sustainable revenue.”

When we compare the numbers for our two Saskatchewan cities to other urban centres, we discover this is one of many factors which contribute to creating a vibrant business community.

Cost of city infrastructure growth

In an earlier post, I discuss the strain imposed upon city infrastructure that is caused by growth.

Saskatoon’s chief financial officer Kerry Tarasoff was recently quoted about the tax increase: “A significant portion of the proposed 2019 budget goes to covering costs for growth and asset preservation.”

Property tax increases are required to keep pace with inflation and to provide the additional cultural amenities to make our Saskatchewan cities even greater.

Looking at other major urban centres can be helpful to determine what we are doing right, and what we could do better.

We’ve got the tax ratios right! Now let’s explore what other jurisdictions are doing to contain infrastructure expansion increases.