Looking back into early 2020 and prior to the pandemic announcement (March 2020), the multi-residential market in Canada overall was perhaps the most solid that it had been in decades.

Looking back into early 2020 and prior to the pandemic announcement (March 2020), the multi-residential market in Canada overall was perhaps the most solid that it had been in decades.

According to CMHC in 2019, the national vacancy rate was 2.00%; the average turnover rate was 17.10%; the average rental growth rate was approximately 4.10% (up from 3.60% the prior period). Within the primary centres, here identified as Toronto, Montreal, Calgary, Halifax, and Vancouver, rental growth rates varied from 1.70% (Calgary) to 6.50% (Toronto). Toronto and Vancouver are market growth leaders both posting 3-year average growth rates of 5.00% or more. Both of these markets are rent-controlled and highly secured by significant legacy (under-market) rent. Most if not all CMHC market nodes in Canada, in 2019 posted positive rental growth. Vacancy rates ranged from approximately 1.00% to 8.40% across the nation however, with an average of 2.00% the upper limits are clearly outliers to an overall trend of generally comprehensive and balanced market conditions.

Giving consideration to the broad regional and local differences between locations in Canada, these statistics defined a Canadian national multi-residential market which reflected a generally narrow band of operational risk and one which was capable of producing a reasonable range of growth. Both free and rent-controlled markets would provide opportunities. Strong immigration, limited supply, institutional market consolidation were a few of the underlying supports to the pre-COVID-19 market. Heading into Q1 2020 strong market conditions had incentivized new rental construction in many markets; the first in decades for many of the larger rent-controlled centres. These projects were in various stages of development and completion.

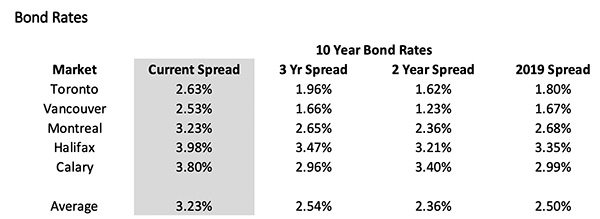

Investment Market: A highly competitive investment market and market consolidation had been an ongoing trend. With most major market players having footholds in primary markets nationally, acquisitions operationally would provide an opportunity for more accretive returns and allow for cap rate compression. The market was looking to diversify across the country and the historic capitalization rate spread between centres nationally was continuing to narrow. A general capitalization rate range of 3.00% to 4.50% was trending within the primary markets – with sweet spots of 3.50% to 4.00% on going-in (institutional quality) accretive acquisitions. In 2019 the mash-up of investment elements produced a national spread between cap rates and 10-year bond rates of approximately 2.50%. 2 and 3-year averages (YTD 2020) per primary centre are below:

Former headwinds suggested a stable spread between bond rates and cap rates prior to March 2020.

Post-March 11th, 2020, and Year to Date – Where are we headed?

The multi-residential market serves as an important benchmark as COVID-19 related market changes are threaded through to discernable numbers, sooner in this asset class than most of the other real estate asset classes. Six months into the pandemic, the multi-res market continues to adjust. Reduced immigration and employment are primary sources of negative rent and forecast adjustments. Rent adjustments include elevated vacancies, reduced market rents, increased bad debts, and incentives. Allowable increases for some rent-controlled markets are lower or in the case of Ontario, frozen for the forecast year.

How the national market is shaped going forward will depend on a variety of factors however those markets which are best diversified, least reliant on narrow tenant profiles or narrow economic inputs, should be best securitized. Secondary factors for markets are many and include local supply, alternative housing options, and pricing, the relationship of the local condominium market to the rental market.

Rent controlled markets (which in Canada include the largest or most significant markets such as Ontario, BC, and Quebec) and which typically have significant below-market legacy rents operate from a position of advantage with respect to hedging rent erosion from sitting tenants. Forecast growth may be down but a strongly underpinned market (operationally speaking) should mitigate rent erosion in these markets. Higher priced rentals should be most at risk; affordable to mid-tier better protected.

Consolidated markets with a high percentage of institutional ownership; market cohesion and cooperation with respect to policies between owners/operators should also be at a position of advantage; now and going forward.

A significant new rental supply will be particularly impactful on the market during more vulnerable market conditions – interim or longer term. Smaller markets or markets which support competitive mid-tier new (as opposed to luxury new) will likely be more susceptible to changing occupancies, flight to quality, etc. that flows from new supply completions. New supply in larger urban markets tends to be luxury by necessity.

Rent and operations management now should be critical to maintaining occupancies and property profiles. Unknowns which currently continue to inject risk into forecasts include the impact of the wind-down of CERB and the risk/likelihood/impact of 2nd or 3rd waves.

Six months into the pandemic, a market which can be defined as active, full, and competitive, has produced little apparent overall shift in capitalization rates in the primary centres. Key trades in larger centres would even suggest some cap rate compression in the most recent data. In the face of some lingering uncertainty and some negative rental adjustment, – what gives?

The impact of interest rates can not be underestimated in the analysis. Based on the 2020 year to date trades (pre and post COVID-19 data included), the spread between bond and interest rates is operating ahead of the historic trend line. Market confidence, available financing, a strong competitive market base, significant capital in the market, and comparative conclusions within the investment market that the multi-residential asset class offers investment security that other asset classes currently do not – must also be reflected in the above.

What trends may be expected?: COVID-19 continues to play with top-line forecasts. As purchasers prioritize, the most vulnerable markets may be expected to be shuffled down. Primary centres with diversified economies, in rent-controlled markets, may be expected to attract the bulk of the attention; this would describe Toronto, Vancouver, and Montreal. Focused demand on these centres may be expected to produce ongoing cap rate compression. Portfolio acquisition which serves to enhance operational efficiencies may be expected to be a strong trend.

Given the foregoing, a growing regional cap rate spread may be expected in the short to medium term at the least.