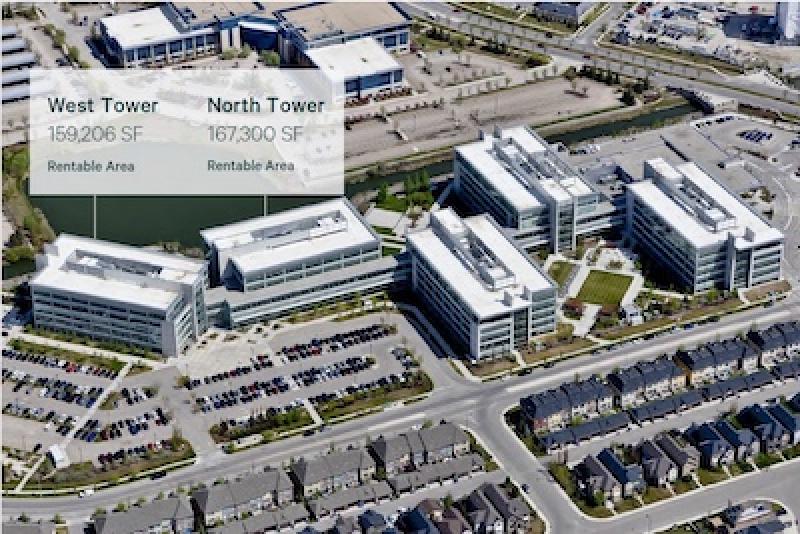

More than 325,000 square feet of high-quality office space in the Imperial Campus in southeast Calgary is for lease or for sale in what is considered one of the best office properties in any suburban Canadian market.

The LEED Gold-certified space includes 159,206 square feet of rentable area in the West Tower and 167,300 square feet in the North Tower.

The available office space, fully furnished, is located in Quarry Park where Imperial Oil moved its head offices in 2016 to five buildings comprising about 800,000 square feet. The energy giant was previously headquartered in the downtown core.

“We currently have more space than we require for the current workforce,” said Lisa Schmidt, Imperial spokesperson, in an email in explaining why the space has become available.

"Best-quality suburban office space in Canada"

Bryan Walsh, senior vice-president of commercial real estate firm CBRE in Calgary, which is marketing the space, said each of the buildings involved in the offering has five floors with highly efficient floor plates averaging 30,000 square feet.

“We’re trying to find an occupier or occupiers and 99 per cent of the time they’re probably wanting to lease, but if somebody comes along . . . and wants to own the real estate we’ll figure out a way. Imperial Oil owns the real estate. If someone wants to buy it, they can sell it,” said Walsh.

“It is by far the best-quality suburban office space in Canada. There’s nothing like it. It’s furnished - high-end furniture. Everything is over the top.

"I’ve gone to some of our other offices and asked them, 'Can you show me the best suburban buildings in Vancouver, show me the best suburban building in Toronto', and this is way nicer than anything there . . . and it’s hardly been occupied.

"It’s not that old and then COVID (hit). There’s hardly any wear and tear shown."

He said the intent is to find larger tenants rather than demising the space.

“We’re not looking for a bunch of small tenants. We’re going after one or more large tenants. We’re not going to split this thing up for a bunch of small tenants.”

Imperial campus features, amenities

Features of the available space include:

- ground-floor pedway and a third-floor pedway that runs through the whole campus;

- nine-foot ceilings;

- full-height, high-quality glazing;

- floor-by-floor compartments;

- each building, including the parkade, is serviced by three elevators and one freight elevator;

- bright, extra-wide exit stairwells located on the exterior with five-storey glass;

- Lutron electric, automatic, programmable blinds;

- white noise cancellation throughout;

- typical floor amenities include large cafe/bistro with additional adjacent kitchen, family room with TV and seating for five, collaboration areas and private phone rooms;

- access to a conference centre (25,000 square feet), market cafeteria (27,000 square feet), fitness facilities and an outdoor basketball court.

The Imperial Campus was completed in 2016 to accommodate about 3,000 employees and designed by HOK and Riddell Kurczaba.

Walsh said Quarry Park is a busy neighbourhood with a retail mall and is easily accessible.

“It’s a suburban campus . . . probably the only big suburban office campus in all of Calgary. Westmount would be the next but after that, there just aren’t any,” he said.

“You go to a lot of big urban centres in North America, you see suburban office campus(es) everywhere. We just have a couple and this is by far the biggest one.”

Slow improvement in Calgary suburban office

According to CBRE, in Q3 2022 Calgary’s suburban office market experienced a third consecutive quarter of positive net absorption at 21,000 square feet, bringing the vacancy rate down to 24.5 per cent.

CBRE said the gains made year-to-date in occupancy now account for a recovery of 25 per cent of the vacancy increase observed during the pandemic.

The suburban office vacancy rate was 20.6 per cent in Q3 2019. In Q3 2021, it was 25.5 per cent and in Q2 2022 it was 24.6 per cent.

“This sector is busier. People trade up. There’s companies trading up to better-quality real estate. It’s reasonably active,” said Walsh.

The CBRE Q3 suburban office report said positive drivers of the market include return to work, reclaimed sublease spaces, owner-user acquisitions and a rare migration out of the downtown core.

“Demand for high-quality buildings with functional improvements will persist,” the report states.