For those looking to occupy commercial space in downtown areas of Atlantic Canada, the old rules no longer apply: “There is a structural shift in demand,” according to real estate consultant Turner Drake & Partners.

The firm's research shows that in downtown areas of six major East Coast Canadian cities (Halifax, Fredericton, Saint John and Moncton in New Brunswick, as well as Charlottetown and St. John’s), rents may have stabilized, but the underlying reality is much different.

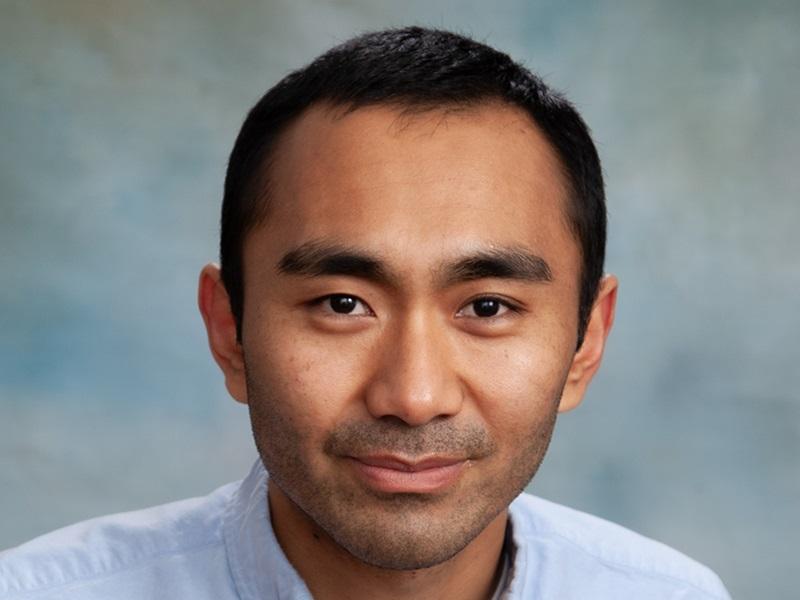

“They all have similar stories of low, declining real rents and increasing vacancy rates,” according to Jigme Choerab, manager, economic intelligence unit with Turner Drake. In an interview with RENX, Choerab said real rents are down between $3 and $6 per square foot when compared to levels in the mid-2000s.

The study's lead article, entitled The Goose That Used to Lay the Golden Egg, is part of the firm’s Winter 2025–2026 Atlantic Canada Newsletter and it upends some views about the state of the market.

“What we found was that there is a structural shift in demand, not a short-term cycle. That means lower prices alone are not going to bring demand back to the previous level. The market is sorting itself out (but) it’s not recovering. It’s doing something else.”

Higher office vacancy but stable leasing rates

The article looked at net rents, vacancy and demand trends across the downtown areas.

“We conducted a survey of all industrial and office spaces across Atlantic Canada. We actually called up every single inventory that exists in Atlantic Canada. We have such rich data, I just figured we should do something about it,” Choerab said.

Whereas other reports have shown that while leasing rates are stabilizing, vacancy remains higher versus previous levels.

“All the time it’s, ‘Rents are going up, vacancies are going up. This doesn’t make economic sense.’ But then we were like, ‘Let’s just figure out what’s happening in real terms,’ ” Choerab said.

When speaking to people involved in office leasing, the context for those numbers became clear.

“I just spoke to a company chairman who always tells me there’s a problem with the office market, that the rents have never recovered since the '90s. Okay, let’s look at the data. We’ll strip out inflation and create a base here, and we’ll check out what the data says,” he said.

Local highlights across Atlantic Canada

When looking at the various cities, some local highlights were exposed:

- Halifax class-A rents are down approximately $4 to $5 per square foot since before 2015, and vacancy has reached as high as 30 per cent;

- Saint John saw openings exceed 30 per cent;

- Moncton experienced a lower vacancy rate of 15 per cent while rents saw downward pressure;

- St. John’s has gone through a post-oil-boom shortfall in leasing activity which has resulted in almost one-third of top spaces available;

- Charlottetown and Fredericton represented the most stable markets.

Overall, the report shows different classes of office space are having different experiences, according to Choerab.

“Class-A still attracting; demand is still there. Between class-A, and class-B and -C, the gap is widening but we’re seeing some sort of stabilization.”

What is causing the shifting trends

This might be good for the short-term, but it won’t bring on a return to pre-COVID and pre-2010 levels, he said. “Stabilization is not the same thing as recovery.”

So why are these shifts happening?

“It’s an amalgamation of various things. There’s higher remote work now, better technology, and the best resources are not located in downtown areas anymore. Absent demand growth or inventory withdrawal — an actual shock — vacancy is going to stay elevated and rents are going to reflect vacancy,” Choerab predicted.

As the restructuring continues, it’s crucial for municipalities to recognize the trend and adjust strategies, Choerab said.

“Downtown office is part of the municipal tax base. I’m sure (officials) understand that structural weakness in the office space is eventually going to show up as fiscal pressure.”

As well, those officials should look to different metrics when planning to entice new business.

“When economic development organizations try to attract investment, they primarily use gross rents. And when developers are trying to rent out their space, they’re showing net rents. That divide is not going to work,” Choerab said.

Time to rethink your office approach

City planners should “be trying to reorient the way of thinking,” and not exclusively focus on downtown cores. “Maybe growth should be more diverse across the areas of the municipality.”

Renters and brokers need to realize the situation is unlikely to revert to previous norms.

“They need to come on the same level, negotiation-wise, because I think they look at the nominal rent going up, and they don’t realize that the real rents aren’t up, and the owners, they see the pressure, but they need to convey the message across in a better way. We need a better picture of the reality on the ground,” Choerab said.

A shift in mindset might help alleviate this pressure.

“While the demand for space might not be that strong, we might need to be prepared for slower growing rents and low vacancy rates,” he said. “Absorption is going to be selective and uneven.”