The GTA industrial investment market remains resilient in 2025. The proof is in the numbers:

Despite the narrative of a “slow market”, 2025 is tracking as the third-strongest year on record for GTA industrial investment by dollar volume - behind only the exceptional 2021–2022 period.

With $1.74B already closed YTD compared to $1.54B in all of last year, 2025 is on pace to approach ~$2.0B. In fact, activity over the past two years has been well above pre-pandemic averages from 2017–2018. While the market has remained active, there has also been a shift in focus as investors have become more selective favouring disciplined underwriting and stable cash-flow-opportunities.

More high-quality “Class A” offerings than in recent years

The GTA has long been undersupplied of modern/ “Class A” industrial investment opportunities - the segment typically most in demand by “institutional” investors such as; pension funds, life insurance companies, and fund managers. Traditionally, “Class A” offerings have represented about a third of sale volume. However, since 2024, that has increased to roughly half. The market remains undersupplied of Class “A” opportunities relative to demand, but the recent increase has contributed to the strong trading volume and resilience of the market.

Institutional investors are buyers

Another emerging trend for 2025 is the return of “institutional” investors as buyers. They are anticipated to account for ~45% of purchases this year - a significant increase from the less than 20% they accounted for in 2024. A combination of three factors are likely behind this shift: (i) More “Class A” offerings that align with their investment mandates;

(ii) Portfolio allocation imbalances created by factors such as the decreased value of office assets within their portfolios have been largely addressed - freeing up capacity to invest in industrial. (iii) Redemption pressures that kept capital sidelined have largely subsided allowing “institutional” investors to put capital in play for real estate investment.

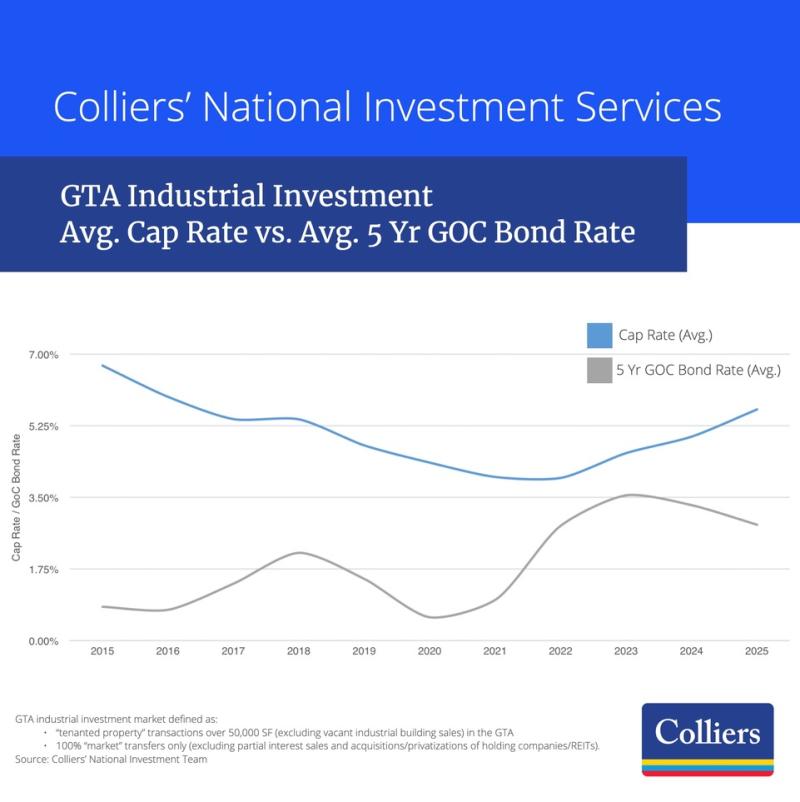

Cap rates have risen, but sale prices per SF remain near historic highs

Average cap rates for GTA industrial investment rose again in 2025 for the third year in a row, however sale prices per SF demonstrate values have preserved. The average sale price for industrial investment in 2025 YTD is $275 per SF. That figure is only ~7% below the peak of $293 per SF from 2023. For context, as recently as 2019, the average sale price was $148 per SF, meaning values have increased 185% over six years – a 10% annualized increase.

Leasing and rent uncertainty have made cash flow king

Typically, cap rates and borrowing costs are closely correlated. In 2025 they diverged. Cap rates have edged up while financing costs have decreased. The cause for this is that industrial rents have begun to “cool”. As of Q3 2025, GTA industrial rents average $16.84 PSF, about $1.62 PSF off the market peak of Q3 2023 – a 4% annual decline. Although the decrease has been modest, investors are currently more cautious when assessing industrial investment opportunities that have near-term expiries and leasing risk. In response, more stable opportunities (ie. longer term lease) that deliver assured cash flow are increasingly in demand. Stability is typically accompanied by a “ceiling” on returns as rental increases are contractual to the lease agreement for the length of the lease term. With limited near term opportunities to increase returns, investors are therefore targeting higher going-in yields contributing to upward pressure on average cap rates.

Risk of “over analyzing” rental rate assumptions 5+ years out

Understanding current market conditions is relatively straightforward, predicting market rents 5+ years out is a formidable task. There’s risk in “over analyzing” rent predictions for investment opportunities with lease rollover 5+ years away. CPI is often used as the basis of predicting market rental rate growth. The challenge is, CPI is relatively stable whereas historically industrial rents in the GTA have not been. Since 2009, industrial rents have experienced annual swings from double-digit declines of -12% to double-digit gains at +36%. Even averaged out over five-year periods, industrial rents have seen periods ranging from -3%, +7% and +22% in annual change.

Drastic swings in rents that few, if any investors, would have accurately predicted over a mid to long-term model. As opposed to potentially “over analyzing” rents, perhaps the emphasis should be primarily on two factors:

(i) Does the investment make sense now? I.e. what can it be leased for today? What is the price per SF and is that below replacement value? Does it deliver cash-flow? Is there confidence on current market leasing assumptions?

(ii) Does the investment make sense long-term? I.e. is there conviction in the sector and asset class? The geographic market? The location? The building? Is it replaceable?

Good time to buy industrial with a long-term view

For investors with a long-term view of the GTA industrial market, now may be an ideal time to be an active buyer. There has been an increase of higher quality Class “A” offerings rarely seen in years prior. Opportunities with cashflow provide a safeguard for any near term rental rate softening and position investors well for the eventual uptick in rents expected as new construction slows to a standstill by late 2026.