Recent Articles

Starwood accepts higher offer from Marriott

Starwood accepts higher offer from Marriott

Starwood Hotels (HOT-N) Monday agreed to a higher $17.8-billion Cdn offer from Marriott International (MAR-Q), a proposal that trumped a bid by China’s Anbang Insurance Group Co. Under the revised merger agreement, Starwood was not allowed to engage in discussions with Anbang.

Reuters – Winnipeg Free Press – Forbes – Globe and Mail

Low loonie has U.S. retailers slowing Canadian entry

At least some U.S. retailers are tapping the brakes when it comes to their Canadian expansion plans. The manager of Winnipeg’s largest regional shopping mall — CF Polo Park — said one U.S. retail chain planning to open a store in the mall this summer informed mall officials it has put those plans on ice.

Boardwalk REIT squeezed by ‘double short’

When it comes to buying and selling units of Boardwalk REIT (BEI.UN-T) these days, investors might want to pay as much attention to the sentiment of U.S.-based investors as they do the fundamentals of the Alberta-heavy multi-residential trust. The Calgary-based company has been targeted by a number of American short sellers.

Property Biz Canada – Motley Fool

ReDev selling four Edmonton-area retail properties

Toronto-based ReDev Properties Ltd. may be close to selling four of its Edmonton-area retail properties. “It is our mandate to look for an exit strategy after five to 10 years, so the timing is in our target,” said ReDev founder and president Richard Crenian.

Time to kill the Sparks Street mall?

Let’s give up on Sparks Street. It’s a failure as a pedestrian mall, a failure as a shopping district, a failure as a roadway. Ottawa’s planning a “revisioning” for it, in keeping with the full-on rethink of downtown brought on by the impending opening of the light-rail line. Perfect. Let’s revision it as a street.

Developer proposes huge Winnipeg theme park

Some developers think big, and then there’s Winnipeg developer Anthony Panchoo. Panchoo is the driving force behind DreamScape Winnipeg, a jaw-dropping proposal that would see a multi-billion-dollar, climate-controlled theme park built somewhere near Winnipeg. The proposed development is up to 500 enclosed acres.

Supreme Court to hear FN claim against B.C. resort

The Jumbo Glacier Resort has hit another bump. The Supreme Court of Canada has agreed to hear a claim from the Ktunaxa First Nation the proposed development would interfere with their religious practices because the resort would be located in an area of spiritual significance and would irreparably harm their relationship with the Grizzly Bear Spirit.

Algae could block Vancouver’s container expansion

The annual spring bloom of microscopic algae coinciding with the migration of hundreds of thousands of western sandpipers could pose a roadblock for Port Metro Vancouver’s planned $2-billion expansion at Roberts Bank in South Delta.

N.L.’s oil boom goes bust

After riding the oil boom for more than a decade, Newfoundland and Labrador has fallen on hard times. Multi=billion-dollar projects have dried up, iron ore mines have shuttered and the fallout of crude’s price plunge has pushed the deficit to a record $2-billion. The province is grappling with a return to “have-not” status.

Slate Retail acquires W. Virginia shopping centre

Slate Retail REIT (SRT.UN-T) announced it has entered into a binding agreement to acquire Charles Town Plaza in the Washington-Baltimore Metropolitan Statistical Area. The property is 99 per cent occupied and anchored by a Wal-Mart. It will be acquired for US$20.9 million (US$100 per square foot). The acquisition is expected to be completed in March.

Solid yields from Dream Global, Artis

Dream Global REIT (DRG.UN-T) allows you to gain access to a portfolio of 208 properties of office and mixed-use space in Germany and Austria. Artis (AX.UN-T) is a diversified REIT that invests and owns about 250 properties in Central and Western Canada and in certain U.S. markets.

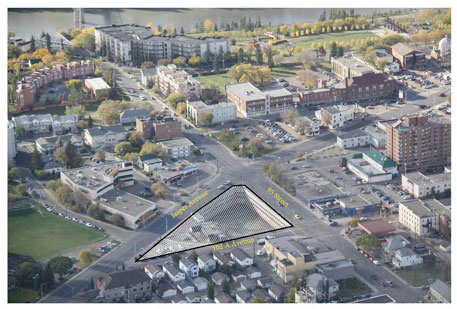

| Development site for sale in downtown Edmonton |

| The City of Edmonton is inviting applications to purchase a prominent high density mixed-use development site, comprising 0.84 acres of developable land, located at the intersection of Jasper Avenue and 95 Street. Open for offers until 4pm, March 23, 2016.

Detailed information package is available at: www.edmonton.ca/propertysales Phone: 780-496-6000 |

CPPIB considering risk-factor approach to infrastucture

The Canada Pension Plan Investment Board (CPPIB) is planning to employ factor investing when sourcing new infrastructure assets, according to one of its senior executives. Rossitsa Stoyanova, director of total portfolio management at the $282.6 billion asset owner, said the investor would like to “get into infrastructure in the factor space”.

Budget should include transit cash: Tory

Every day, more than 2.7 million trips are taken on Toronto’s transit system. In Montreal, more than 2.2 million are taken on the Metro on an average day, while the Vancouver system sees more than 1.1 million. As of 2014, Canada’s three largest cities were among the top 10 busiest transit systems in North America.

Globe And Mail – Financial Post – Vancouver Province – Maclean’s

Virtual reality to make mark on retail branding

Retail marketers eager to invent ways to engage with customers digitally should closely study augmented- and virtual-reality technology. AR/VR represents a powerful new technological medium that allows retailers and brands to provide consumers with immersive and experiential marketing experiences at scale, while creating innovative digital paths to product discovery high on emotional impact.

Globe and Mail – Financial Post

U.S. industrial demand strongest ever?

The U.S. economy may be growing slowly, but the industrial market just finished one of its best years ever, and 2016 is already shaping up to be another year of declining vacancy, rising rents and robust levels of new construction. That’s the conclusion of a new report on the sector by Colliers International.

Featured Column

Alternative asset classes a riskier investment

Alternative asset classes a riskier investment

Generally, investors in commercial real estate are familiar with more mainstream assets usually classified as multi-family or apartments, retail property and office property. For investors they are usually not as big a risk as investing in alternative asset classes.

Crowdfunding: Making CRE investing a reality for more Canadians

Crowdfunding: Making CRE investing a reality for more Canadians

Real estate investing is a staple for Canadians. Whether it’s owning your own home, buying a publicly listed REIT or buying and renting a condo unit, Canadians are obsessed with investing in real, tangible assets they can see and touch.

Market Trends and Research

CRE lending moderating

Commercial real estate liquidity, which had been showing signs of overheating in the form of loosened underwriting and cap rate compression, appears to be moderating this year in reaction to market and regulatory forces. It has been particularly evident in the CMBS market, which has seen a marked slowdown in activity.

Office tenants deploying ‘smarter’ workplaces

Chelmsford, Mass.,-based Kronos Inc. decided to pull out all the stops when it planned to relocate and expand its headquarters into 400,000 square feet of leased space in the neighbouring Boston suburb of Lowell, adding a fitness centre, daycare centre, game room, restaurant and bar, and other millennial-favoured perks as part of a $40-million renovation.

|

Canadian Metropolitan Outlook: Winter 2016 |

| The Conference Board of Canada publishes a quarterly overview of the outlook for the economies of metropolitan centres in Canada. It provides a national overview and individual city reports, as summarized in this RENX chart.

Conference Board of Canada: Metropolitan Outlook Chart: Winter 2016 |

Real Estate Companies

Airbnb opens Cuban listings to world

Online lodging service Airbnb is allowing travellers from around the world to book stays in private homes in Cuba after the San Francisco-based company received a special authorization from the Obama administration, Airbnb announced Sunday. Airbnb was the first major American company to enter Cuba.

Winnipeg Free Press – Curbed Los Angeles

Empire stocks hit a 52-week low

Market volatility has brought many successful stocks back into value territory. Recently hit is Empire Company Limited (EMP.A-T), a real estate conglomerate with more than 1,800 retail locations comprising 35 million square feet of space. Its biggest holdings are its full ownership of Sobeys Inc. and a 41.5 per cent equity interest in Crombie REIT (CRR.UN-T).

Norway pension fund manager cools on property

Not seeing a correction in property prices they expected, investment managers of the world’s largest pension fund, Norway’s Government Pension Fund Global worth roughly $1.14 trillion Cdn, say it may be time to sit on the fence before making any more big bets on the global property markets.

REOC Financial Reports

Real Estate Investment Trusts

RioCan REIT a powerful investment

If you are thinking about how your investments can actually generate income while also lacking much volatility, you really can’t go wrong with RioCan REIT (REI.UN-T). Some call it Canada’s top REIT. RioCan owns 293 retail operations with a grand total of 37 million square feet. Further, it has 5.5 million square feet of retail space in development.

Motley Fool – Property Biz Canada

IRET doubling down on multi-family

Perhaps proving investors can make money in any real estate market no matter how tough the conditions, Investors Real Estate Trust (IRET-N), a North Dakota-based publicly traded REIT, reported increased growth and profits for its nine-month period ended Jan. 31, 2016.

Blackstone Mortgage Trust undervalued

An undervalued REIT is Blackstone Mortgage Trust (BXMT-N), a real estate finance company that originates and acquires senior loans collateralized by properties in North America and Europe. It’s among the best growth-and-income plays. When interest rates are low, Blackstone Mortgage Trust is a great investment, with its attractive yield and great potential for earnings growth.

Ascott REIT acquires Sheraton Tribeca

Ascott Residence Trust marked its 10th anniversary with the acquisition of its second property in New York. The Singapore-based REIT acquired the 369-room Sheraton Tribeca New York Hotel in the heart of Tribeca, one of the priciest residential neighborhoods in Manhattan. The REIT paid $158 million US or roughly $428,185/room.

Retail

U.S. retail sales dip in February

U.S. retail sales fell less than expected in February, but a sharp downward revision to January’s sales could reignite concerns about the economy’s growth prospects. Tuesday’s weak report from the Commerce Department bucked the trend of recent labour market data that had suggested the economy remained on solid ground.

Restaurants and Eateries

The ghosts of venues past: The Zoo

The fences went up quietly, sneaking around the edges of the space like an orange warning snake. Whatever happens next, it sure looks as if the Osborne Village Motor Inn is going away. Or at least, the shell of it may be. The heart of the iconic Winnipeg dive hotel has already been cut away.

New Development

Omicron unveils Sidney Gateway mix

Just how hungry are the citizens of Sidney? Omicron, the developer of the Gateway shopping centre, says local shoppers are under-serviced when it comes to buying food — even though there are three major grocery stores nearby. Peter Laughlin said Omicron is talking with two major Canadian food retailers to form its anchor store.

Renovation and Restoration

Designer doesn’t want Winnipeg’s PSB torn down

A veteran architect and designer of more than 100 buildings, Leslie Stechesen has truly left his mark on the city of Winnipeg. The home of Royal Winnipeg Ballet, the expansion to the Pantages Playhouse Theatre and St. John Brebeuf Church . . . but there’s one structure he helped design in his mid-20s he’s hoping outlives him.

Winnipeg Free Press – Winnipeg Free Press

Beverly Center set for major reno

Taubman Centers announced a plan to completely renovate the Beverly Center, an 886,000-square-foot iconic mall in Beverly Hills. The renovation will modernize every aspect of the center, from the exterior to the interior, and will make the center more pedestrian friendly. The renovation will start this year and will be completed by the holiday season of 2018.

Infrastructure

N.S. ponders twinning 300 kilometres of highways

Nova Scotia’s highways department is looking into the financial feasibility of twinning about 300 kilometres of its 100 series highways. At a construction cost averaging $5to $6 million per kilometre for two lanes, possibly done over a five-to seven-year period, the highway improvement program would be a boon to roadbuilders across the province.

Brazil increases foreign ownership on airlines

Brazil has lifted the legal limit on foreign ownership of local airlines to 49 from 20 per cent, according to a presidential decree, opening the door to more help for troubled carriers. Weak domestic demand and the sharp depreciation of Brazil’s currency have caused deep operating losses, forcing airlines to cut routes and jobs and seek foreign partners.

Technology

Alberta casino hit by cyberattack

A cyberattack at the River Cree Resort and Casino in Enoch, Alta., resulted in the theft of customer and employee information. River Cree president Robert Morin, in a written statement, said the attack occurred Monday. It did not include theft of information from the casino floor.

Other

|

RENX has surpassed 8,875 Twitter followers |

| Follower Bonneville Multifamily Capital specialized in multifamily USDA and HUD/FHA loans. Based in Salt Lake City, UT it is the largest USDA lender in the country. | |

| Follow RENXca, the most comprehensive news feed on Twitter for Canadian real estate professionals. |

Industry Events

Industry Events

-

MIPIM - The Global Urban Festival

Mar 09 2026

to Mar 13 2026

Palais des Festivals, Cannes, France -

Vancouver Real Estate Forum

Mar 31 2026

to Apr 01 2026

Vancouver Convention Centre West -

Montréal Real Estate Forum

Apr 14 2026

to Apr 15 2026

Palais des congrès de Montréal -

BOMA 2026 CRE Symposium

May 07 2026

Dieppe, NB -

Western Canada Apartment Investment Conference

May 12 2026

Edmonton Convention Centre